The Central Bank of Nigeria (CBN) is concerned about the difficulties people are having withdrawing money from their bank accounts and other alternative channels.

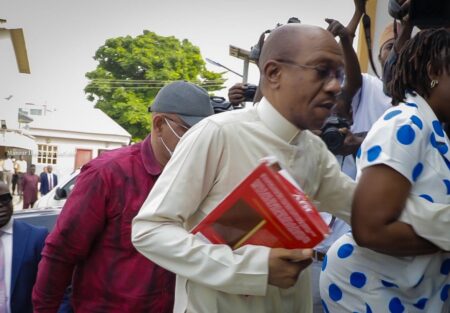

This was said on Saturday in Kaduna during the CBN Special Day at the 44th Kaduna International Trade Fair by the bank’s Director of Corporate Communications, Mr. Osita Nwanisobi.

Nwanisobi, who was represented by Mohammed Abbah, Director, Capacity Development in the bank, asserted that the currency redesign had numerous, significant benefits that would eventually help the economy.

“Indeed, there have been reports of occasional transaction failures, we wish to assure you that the Nigerian payment system infrastructure is robust enough to handle the surging transaction volumes across all channels.

“We, therefore, urge Nigerians to embrace alternative payment channels, such as eNaira and internet banking as we embrace the cashless policy,” he said

Nwanisobi said the policy was not targeted at anyone or any group of persons rather aimed at strengthening Nigeria’s macroeconomic fundamentals and better our socio-economic conditions.

He said the aim of the currency redesign was to make the country’s monetary policy more efficacious which resulted to relatively stable exchange rate.

The Director said the policy also aimed at combating banditry and ransom-taking while increasing financial inclusion by reducing the number of the unbanked population in the country.

According to him, the CBN is focus on stimulating productivity in the manufacturing sector, strengthening domestic industries, transforming agricultural output to ensure self-sufficiency and shield local economy from harm.

He said the apex bank in collaboration with the Nigerian Inter-Bank Settlement System (NIBSS) recently unveiled the National Domestic Card Scheme, the first in Africa.

The initiative, he said, would lower operating cost incurred by banks through huge charges for foreign card schemes while reducing foreign exchange commitments associated with operating such cards.

According to him, the apex Bank has released funds to support various initiatives such as the Anchor Borrowers’ Programme (ABP), the Commercial Agriculture Credit Scheme (CACS), and the Tertiary Institutions Entrepreneurship Scheme (TIES) between 2015 till date.

“Similarly, the bank has supported the Micro, Small and Medium Enterprises (MSMEs) sector, the Agribusiness/Small and

Medium Enterprise Investment Scheme(AgSMEIS) and Micro, Small, and Medium Enterprise Development Fund (MSMEDF).

“Under the Export Development Fund (EDF) and Export Facilitation Initiative (EFI), the CBN has funded several projects for non-oil export commodity value-addition and production in excess of N11 billion and N3 billion, respectively”. (NAN)